A credit report is a detailed breakdown of your credit history prepared by a credit bureau. The three major credit bureaus—Equifax, Experian, and TransUnion—collect financial information about you and compile their reports based on that information. They are each required to provide you with a free report at least once a year.

Lenders use the reports, often along with other data, to determine your creditworthiness. Insurance companies, employers, and landlords may check your credit reports, as well. These reports focus primarily on your use of credit. They do not include information on other types of bills. Nor do they show your income, investments, or other assets.

Staying on top of your credit history is important to your financial well-being—and knowing what is in your credit report is the first step. Depending on where you obtain your credit report, you may notice that the information is presented differently or in varying formats.

Credit reports typically divide information into four sections. These are:

Personal Information

The top of the report contains personal information to identify you, including your name (and any variations of your name that you use), address(es), date of birth, spouse or co-applicant, and phone numbers.

Accounts

The second section represents the bulk of most reports and includes detailed information on your past and present credit accounts, both revolving credit, such as credit cards and lines of credit, and installment credit, such as auto loans, personal loans, and mortgages. It will indicate when you opened the account as well as its current status, such as whether it is open or closed. In addition, and most importantly, it will show whether you have kept up with your payments on that account or fallen behind.

Public Records

The third section includes public records regarding any bankruptcies, legal judgments, or tax liens. It does not include non-financial matters, such as arrests.

Credit Inquiries

The bottom of the report lists all of the entities that have recently asked to see your credit report. These fall into two categories: hard inquiries, which happen when you apply for credit, and soft inquiries, which occur when a potential creditor requests your file without your knowledge for marketing purposes. Hard inquiries can have a negative impact on your credit score, although it is usually brief.

How Long Does Information Remain on Your Credit Report?

Information on your credit report will typically remain for at least seven years, after which it basically falls off. One exception is Chapter 7 bankruptcy, which can remain for up to 10 years.

Who Can See Your Credit Report?

Under the Fair Credit Reporting Act, businesses and other parties need a legally permissible reason to request your credit report. That list can include lenders, insurance companies, employers, landlords, and government agencies. In the case of employers, you must give your permission in writing.

Read these articles to continue learning more on credit reports.

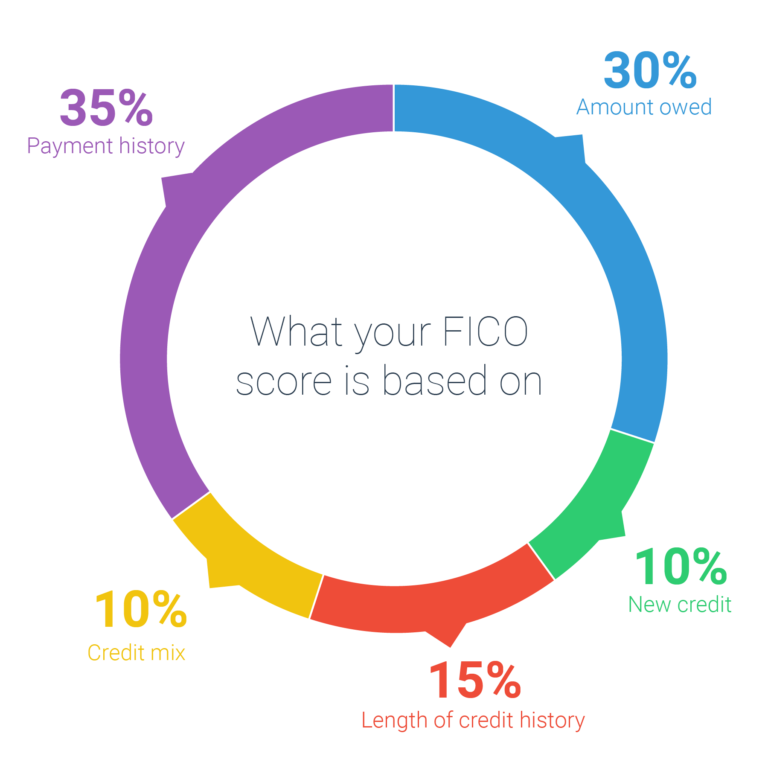

Credit scores are three-digit numbers, typically ranging from 300 to 850, that serve as a sort of shorthand for your creditworthiness. The information in your credit reports is used to compute your credit scores, but the scores themselves are not part of your report and must be obtained separately.